Caution is the best policy

Insurance for plumbing professionals is far more complex than many people realise – and ignorance of key concepts can lead to disaster. John Power reports.

Busy plumbing professionals might be forgiven for glossing over the fi ne print in their insurance policies. It’s no secret the task of assessing the relevance, completeness and value of an insurance package can be an administrative torment.

Nevertheless, inadequate or incorrect insurance cover has the potential to destroy a plumber’s business and personal estate, and tales of woe are both common and gut wrenching.

In this article, we attempt to describe the main types of insurance for plumbers, provide some guidelines about mandatory and discretionary features that apply in different States and Territories, and spell out the common dangers and pitfalls that might catch out unsuspecting plumbers when they are purchasing cover.

Victoria: the odd man out

When examining insurance for plumbers, it quickly becomes apparent that there is no national consistency in the sector, as each State and Territory has different requirements.

There is no doubt that Victoria has the most complex insurance and is the ‘odd man out’. Victorian plumbers are the only practitioners in Australia who MUST hold specific types of insurance as a condition of their license. No insurance: no license.

The Victorian Building Authority advises that Victorian plumbers cannot be licensed unless they hold insurance cover against:

- Defective plumbing work,

- Trade Practices Liability,

- Non-Completion of Work,

- Public Liability, and

- Completed Works.

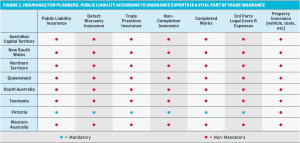

Insurance Cover addressing all the above criteria is a legislated requirement in Victoria, as defined by the Ministerial Order – Licensed Plumbers General Insurance Order 2002. There is also full protection for the reasonable legal costs and other expenses incurred by a property owner in making a claim against the plumber for any liability under the Order. None of these types of insurance is compulsory in the remaining States and Territories of Australia, though many contracts will stipulate that plumbing professionals carry at least some level of Public Liability insurance. See Figure 1.

Although it is only mandatory in Victoria, the main purpose of Public Liability insurance is to protect practitioners from the potentially high costs of replacing or paying compensation for third-party property damage or personal injury. For example, let’s say a burst water pipe leads to the flooding of a garage containing a Ferrari. If this is found to be due to negligence on behalf of the plumbing practitioner, their Public Liability insurance should respond to cover the costs of repairing the garage and the Ferrari.

Similarly, let’s say the same mishap causes the property owner to slip and suffer a broken leg, then Public Liability insurance should respond to cover all costs relating to the victim’s rehabilitation and treatment. It is important to note that regular Public Liability cover does not apply to plumbing employees, nor does it cover the costs of repairing defective works. It may also exclude works carried out by contractors and subcontractors – more on this later.

The second main type of insurance required by Victorian plumbing professionals is Defect Warranty insurance, also known as Warranty insurance or Consumer Protection insurance. This cover is designed to protect both the client and the practitioner, and applies to the costs of rectification of defective plumbing work. Policy holders in Victoria must have Public Liability insurance to a value of at least $5 million, and Defect Warranty insurance to at least $50,000 value per home for domestic work and $100,000 for non-domestic work.

It’s also important to consider that the stated $50,000 domestic work limit in Victoria for Defects Warranty is potentially only a part of the picture should a claim arise. Let’s look more closely at these two major types of insurance before examining other types of insurance and some pitfalls to guard against.

Public liability

As the most ‘front of mind’ kind of insurance affecting plumbing professionals, Public Liability insurance is regarded as a business necessity for all responsible plumbing businesses, but there are plenty of practitioners (outside Victoria) who lack this basic protection.

David Pockett, Chartered Loss Adjuster and Director of Metropolis Solutions, based in Melbourne, has significant experience in plumbing compliance assessments relating to insurance claims. David says plumbers who do not carry Public Liability insurance could be faced with “an absolute disaster” in the event of commonplace mishaps.

“Let’s say a plumber does a bit of work on a domestic hot water service, everything seems right and he leaves, and then three hours later the house catches fire and burns down, and this is subsequently proven to be due to a smouldering fire caused by one piece of hot slag that dropped somewhere during brazing – that’s when you need Public Liability insurance big time,” he warns. Accountability is made all the more complicated when subcontractors are involved.

“A lot of liability policies will exclude cover for contractors,” David says.

“You often have to buy that separately.”

In most Public Liability claims involving multiple layers of contractors and subcontractors, a claim will be lodged against the principal contractor in the first instance, David says, but it is increasingly common for litigation to target all relevant subcontractors involved.

“If anybody were sued they would start with the principal contractor,” he says, even if the principal contractor wasn’t directly engaged in the faulty work.

“But in Victoria there is something called the Wrongs Act 1958 whereby you can have an ‘apportionable’ claim. The law has changed in recent years in Victoria, which encourages the litigant to sue everybody who has had anything to do with the job; each party will only pay a portion [of the claim] according to their liability.”

These laws may vary considerably from State to State. It is important, therefore, for principal contractors to ensure all subcontractors are properly insured. Even if a Public Liability claim is satisfactorily covered by the plumber’s insurance policy, it is also important to note that Public Liability does not offer financial protection against defective workmanship or products.

Just as critically, Public Liability Figure insurers of other entities can launch their own recovery actions against other parties such as plumbers whom they believe to have contributed to a loss, even if the plumber was not involved in the original litigation or claim.

Defect warranty

This form of insurance, available only to Victorian plumbers, is the most fraught of all types of policies, as it seems at face value to be anathema to other types of policies, including Public Liability, which list defective workmanship or faulty products as specific ‘exclusions’ to valid claims.

Designed primarily as a protection for consumers (but also working to protect plumbers), Defect Warranty insurance needs careful definition. No other States or Territories offer this insurance because it is deemed too risky and open to abuse – for example, a sloppy plumber might cut corners, safe in the knowledge that an insurance company will ultimately bear the cost of repairing the defective workmanship.

Nicholas Burt, the Melbourne-based Manager of the Trades Division for insurance broker Marsh Advantage Insurance (official ‘preferred broker’ of the Master Plumbers and Mechanical Services Association of Australia), says Defect Warranty insurance therefore has to balance the genuine interests of consumers with the bona fides of plumbing professionals.

As a means of formalising the terms of Victorian plumbers’ insurance relating to defects, the Ministerial Order details the obligations and responsibilities of insurers, though interpretations of these clauses can vary greatly. At the heart of the Ministerial Order, however, is a directive to insurers that they must not rely on standard insurance prohibitions or exclusions when assessing Defect Warranty claims or any other claims under the Order.

“There’s actually a section of the Victorian Ministerial Order,” Nicholas says, “which talks about ‘Prohibited Provisions’ and it really prohibits insurers from restricting policies to cover certain things that they would probably restrict otherwise.”

Specifically, the Order states that in relation to Prohibited Provisions: The policy must not have any provision that limits the indemnity provided under the policy with respect to any defect as a result of –

- any loss or damage to that part of the property on which the plumber is working and which arises out of that work;

- any error in design, specification, formula or pattern or the provision of advice that is incidental to any plumbing work undertaken by the plumber;

- the cost of inspecting, repairing or replacing component parts of plumbing work. This means the consumer is also protected by Defect Warranty insurance even if the damage arises from poor design work – but ‘design’ could easily be a very subjective term!

“A Public Liability insurance policy, for instance, generally doesn’t cover professional indemnity, so if you’re talking about ‘advice’ or ‘design-based’ work you typically require a separate Professional Indemnity policy,” Nicholas says.

“Public Liability policies generally exclude design and advice-based claims in their entirety, but this legislation actually writes it back in [via Defect Warranty] to a limited extent by stating ‘the policy must not have any provision that limits indemnity provided under the policy with respect to any defect as a result of… any error in the design specification.’

“It is important to note that the Prohibited Provisions clause relating to ‘any error in design, specifi cation, formula…’ only relates to associated design and advice that is incidental to general plumbing activities where the Insured is completing work themselves.”

According to David Pockett, there’s also understandable confusion among insurers themselves about the signifi cant diff erences between Victoria and all other States, so plumbers have to tread carefully. Furthermore, David says insurers’ Defect Warranty obligations in Victoria, as described above, do not sit well with insurers’ incredible powers in that State to instruct plumbers to rectify work at their own cost or else potentially lose their plumbing license.

Specifically in Victoria, clause 221ZV of the Building Act 1993 stipulates that, “An insurer can apply to the Authority for the suspension of the license of a licensed plumber on the ground of a failure by the plumber to comply with a reasonable direction of the insurer in respect of completion or rectification of defective plumbing work…”

This immense power of insurers over plumbers, David asserts, might lead some plumbers to feel intimidated or threatened into rectifying work at their own expense when the insurer should actually be absorbing some or all of the costs. Finally, in reference to both Public Liability and Defect Warranty insurance in Victoria, both David and Nicholas point out the inconsistency in these policies’ respective periods of cover, namely annual renewal intervals for Public Liability and six-year periods for Defect Warranty insurance.

“To talk briefly about the rectification of defective work, in Victoria plumbers are required to fi le a compliance certificate upon completion of a job, and upon completion the insurer who holds the plumber’s liability and warranty policies is required to provide cover to the consumer for six years from the date of those works,” Nicholas explains.

“I think the Victorian Building Authority needs to educate people a little bit more on this matter. It does appear to me there’s a loophole – if you were really trying to protect the consumer you would say the rectifi cation (covered by Defect Warranty insurance) AND any resultant damage (covered by Public Liability insurance) BOTH need to be securely covered for six years.”

If a plumber doesn’t have insurance, of course, and if something goes wrong and a claim is made against them, then their personal assets such as car, house, business, etc, could all go on the line – it could be an absolute fi nancial disaster. By far the safest solution for plumbers who retire or change profession is to take out an appropriate ‘run off ’ Public Liability policy and continue to renew for six years after they have fi nished working as a plumber. Moreover, it is worth remembering that insurance often ‘dies’ with the plumber if he or she passes away and the policy isn’t renewed. The purchase of run off insurance by the plumber’s executor should therefore be investigated in many situations, but particularly in Victoria where the main consumer protection insurance is compulsory, putting the plumber and his estate at potential risk for at least six years. Despite this scenario, there is no ‘requirement’ for run off cover whatsoever!

Trade practices

This insurance poses further conundrums, with few experts able to explain precisely what its role is in the overall arsenal of insurances.

“In my time at Marsh Advantage Insurance we’ve never had a claim relating to Trade Practices Liability,” Nicholas says.

David, on the other hand, says he is aware of at least one instance where Trade Practices cover came to the rescue of a plumber who had done work at an educational facility in Melbourne – See Case Study 2.

Non-completion

Once again, this insurance cover is termed minor in the context of overall plumbing insurance. How this level of cover differs from unsatisfactory or defective work lies in the detail, but it exists largely to protect the consumer in case a plumber disappears, dies or for any other reason fails to complete contracted works which have already been paid for.

Completed works liability

This is a unique cover required only in Victoria, but unfortunately, according to David Pockett, its definition in the Ministerial Order is commonly misunderstood, and there remains great uncertainty among the insurers about what it actually covers in the case of plumbers. In the normal insurance sense, it usually refers to cover paid for in advance to protect against liabilities which might arise after the job is completed and handed over.

But the Ministerial Order appears to require a completely different cover because it contradicts this idea by specifically referring to this liability arising only ‘during the period of insurance’. It also requires annual renewal of the insurance to continue cover – something that doesn’t happen with normal Completed Works policies either, so the jury is still out on this one.

Workers comp, vehicle, income and more insurance options

In addition to the above mandatory insurances in Victoria, plumbing businesses throughout Australia require Workers Compensation cover if they operate as a P-L company and, in some States like Victoria, also for any employees of a sole trader or partnership (other than the owner/s). Checking local laws is important to make sure plumbers comply with their obligations.

Bernard Tuaimau, a qualified broker from MGA Insurance Brokers in NSW, says most clients are also interested in insuring property like motor vehicles and tools. However, he says there is a large range of other policies that really ought to be considered as well.

“There are other insurances that aren’t considered as often as they should be – these ‘intangibles’ for companies relate to employment related claims or injuries on the worksite. There’s a policy called Management Liability which incorporates different types of cover directed at offices and employment practices, aimed at covering the business from other claims such as someone being injured on the worksite and the client being sued or issued a fi ne or penalty or claims in relation to employees, i.e. unfair dismissals, bullying, those types of things.

These types of exposures can be covered under an insurance policy and it’s probably something a lot of plumbers don’t have… but they are getting wiser about taking out these kinds of insurances.” Plumbers should also consider taking out personal Income Protection and/ or Life Insurance if there is any chance they won’t be covered under Workers Compensation, or else want to protect themselves against non-work-related injuries or illness.

How to buy insurance

There are two main avenues to purchase plumbing-related insurances: via a broker, or direct from an insurance company. Most small suburban plumbers deal directly with large insurers, though a growing number of professionals are choosing to follow the lead of larger firms and use a broker.

Why use a broker at all?

“As a broker we carry specific questions whereby clients will give certain scenarios, and we can answer because we’re qualified to give advice, whereas if you call a direct insurer they will generally only give advice about what’s in their product portfolio,” Bernard says.

Brokers are also able to customise insurance packages sourced from different insurance companies, generally with some level of discounting based on volume purchasing agreements. In addition, brokers have access overseas insurance channels that would not be available to end customers. Most importantly, brokers are able to explain precisely what policies do or do not cover, hopefully averting unwanted surprises later on.

“It all comes down to communication and being told up front what it is you’re purchasing,” Bernard concludes.

Disclaimer: This article contains general information, does not take into account your individual objectives, financial situation or needs. For full details on insurance policies please refer to the specific policy wordings and/or Product Disclosure Statements available from the insurer.