‘Clean’ hydrogen… of pipedreams and smokescreens

The promise of a new ‘clean’ hydrogen industry has government and industry advocates frothing at the mouth, all keen to gain a slice of the new Hydrogen Economy. But is ‘clean’ hydrogen production feasible? And are proposed domestic applications just a smokescreen for the real prize: export dollars? John Power reports.

In August 2018 the COAG (Council of Australian Governments) Energy Council commissioned Chief Scientist Dr Alan Finkel to create a proposal for the development of a National Hydrogen Strategy.

Dr Finkel’s proposal was released in December 2018, and since then a COAG Energy Council Working Group, operated by the Department of Industry, Science & Innovation, has been busy responding to the proposal’s recommendations by disseminating nine Issues Papers, overseeing subsequent public submissions, and generally helping to “build momentum” for a proposed new era of hydrogen-based energy.

The completed National Hydrogen Strategy is due for release at the end of 2019.

HYDROGEN’S DIRTY SECRET

When burned in air hydrogen emits nothing but water vapour, hence its status as a ‘clean’ fuel. By contrast, combusted fossil fuels like natural gas (which is composed primarily of methane), coal, and oil all produce unwanted emissions containing carbon dioxide (CO2).

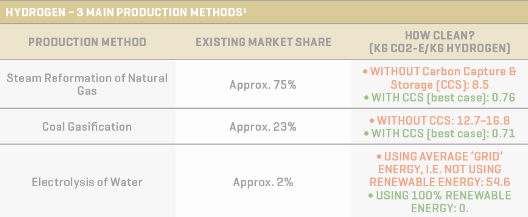

While hydrogen itself is a clean gas, its production can be decidedly dirty depending on the methodology of its manufacture, including the presence or absence of associated cleaning technologies like Carbon Capture & Storage (CCS).

CCS treatment is costly and rare; there are only a few dozen CCS-equipped plants operating in the world at commercial scale, and their long-term effectiveness to date is mostly anecdotal, typically involving underground storage (sequestration) of CO2.

As the table illustrates, the ‘cleanness’ of hydrogen produced at scale is, at best, highly dubious, with all hydrogen manufacturing technologies producing some CO2. The only exception is electrolysis of water linked to 100% renewable energy sources like solar or wind; there is only one such commercial-scale plant operating in the world.2

Despite the highly experimental nature of ‘clean’ commercial hydrogen production technologies, and regardless of the open-ended status of ongoing research, the initial documentation released by the COAG Energy Council Hydrogen Working Group reads more like a corporate business proposal than an independent scientific backgrounder.

The Issues Papers, in particular, demonstrate clear advocacy for yet-to-be-proven features of hydrogen industrialisation; as we will discuss below, this advocacy is based on political assumptions, false scientific extrapolations, scant regard for hydrogen’s merits compared to other (cleaner) energy sources, and a preoccupation with the ‘perception’ of clean hydrogen production rather than its reality. Let’s dig deeper.

EXISTING APPLIANCES REDUNDANT

As far as clean hydrogen applications on Australian soil are concerned, the Issues Papers propose a range of potential applications, from blended hydrogen/natural gas piped directly to homes, to industrial use and long-term energy storage solutions. Hydrogen gas blends, in particular, are touted as a great way of reducing overall CO2 emissions when distributed via existing pipe infrastructure.

“Existing studies show that, generally, blending at relatively low hydrogen concentrations (up to 10–20%), may not require major investment or modification to infrastructure,” Issue Paper 6 states.3

Furthermore, Dr Finkel’s Proposal stresses that “kick-start projects could be progressed immediately,” including, “Commencing work to allow up to 10% hydrogen in the domestic gas network, both for use in place of natural gas and to provide at-scale storage of hydrogen.”4

“In an Australian context this conclusion is premature,” says Gas Appliance Manufacturers Association of Australia (GAMAA) president and SIT Gas Controls managing director Ross Jamieson.

“Some appliances may be able to cope with a 10% hydrogen mix, but initial indications are that this is towards the top of their operational limits. At concentrations higher than 10% we are probably looking at the need for different appliances.” In other words, existing gas appliances would need to be replaced with new hydrogen-compatible appliances if a gas blend with more than 10% hydrogen were to be adopted. There might be some unusual exceptions, Ross concedes, but these would have to be identified on a model-by-model basis.

Even worse for proponents of blended hydrogen, Ross cautions, is the likelihood that even a 5% blend of hydrogen might be incompatible with existing appliances.

How could the Working Group’s initial proposals have been so wrong? Ross suspects that the authors of the Issues Papers might have observed European gas blend characteristics, and wrongly extrapolated that data to Australian conditions. The problem lies with gas purity – Australian gas is more refined and pure than European gases.

“I think the 10% assumption is based on European norms, where they already have a requirement for a ‘limit gas’ of 23% hydrogen,” he says. “Here in Australia we traditionally have a better-quality gas with tighter controls on what’s coming out of the network, so we have a ‘limit gas’ of 13% hydrogen,” Ross explains.

“So, in Europe they could potentially introduce a 10% hydrogen/natural gas mix without too many issues, but here in Australia where we have that lower limit gas, it precludes that automatic assumption.

“When you say, ‘We’ll just add 10% into the appliance and crank it up to 20% and everything will just work,’ it’s like asking someone with a diesel car to go and put 10-20% unleaded in the tank as well, and assuming it will be OK…”

GAMAA has lodged a public submission with the Working Group formalising their concerns about their assumptions regarding a 10% hydrogen blend.

In a separate submission to the Working Group, Rheem Australia general manager corporate affairs Gareth Jennings has reiterated GAMAA’s concerns. “We wish to reinforce their [GAMAA’s] comments regarding the dangers of assuming a 10% hydrogen mix in the gas networks would be ‘safe’,” Gareth writes.

“Until complete testing is undertaken we would advise against making assumptions based on the preferred outcomes of some in the industry.”

DIFFERENT GASES

How do hydrogen-compatible appliances differ from standard natural gas-compatible appliances?

As Ross states, “You are talking about two very different gases – natural gas has a reasonably narrow band between the LEL (lower explosive limit) and HEL (higher explosive limit), whereas hydrogen gas has a much wider band between the two. Also, the flame speed of hydrogen gas is significantly greater.

If you try to run a high concentration of hydrogen through a natural gas appliance, then you are more likely to get ignition problems and light-back at the injector, which can cause damage to the appliance. The different types of appliances such as atmospheric and forced draft will behave differently, as will the burner types such as bunsen or pre-mixed. Pre-mixed burners would require a complete change in tuning due to the volume of hydrogen required to give the same energy content.”

So, is hydrogen likely to grace our domestic pipelines any time soon?

“There is nothing wrong with this ambition; however, it has to be based on sound technical consideration of all aspects, and this includes the appliances which, after all, have to burn the actual gas mixture at the end,” Ross says.

These revelations beg the question: if a modest hydrogen blend necessarily mandates the replacement of most gas appliances, then might it be more economical in the longer term to ‘go all out’

and opt for 100% hydrogen delivery for suitably compatible appliances?

Such a rollout might be feasible, as shown with the conversion from town gas to natural gas in the late 1960s, says Energy Safe Victoria (ESV) Type A Gas Appliance & Component Safety manager Enzo Alfonsetti. ESV is an independent statutory authority responsible for regulating gas safety throughout the State’s transmission, distribution and end use infrastructure – the agency is not involved in regulating gas production safety.

According to Enzo, ESV is contributing to the National Hydrogen Strategy in numerous ways at state and national levels by participating in workshops and offering technical advice. ESV is also involved in a Standards Australia committee (ME-093) tasked with assessing how Australian Standards might have to be adapted to suit the adoption of hydrogen into local networks.

Enzo says that one of the issues to overcome are high-pressure transmission steel pipelines, where hydrogen embrittlement can occur. Research is underway to determine limitations on pressure and pressure cycling that would prevent embrittlement. Lower-pressure distribution pipelines, he says, are less problematic, as older cast iron pipelines, from which tiny molecules of hydrogen can leak, are being replaced due to ongoing upgrades with polyethylene (PE) piping, which is compatible with hydrogen.

Nevertheless, practical issues relating to hydrogen adoption remain. For example, in the event that hydrogen were adopted for domestic use, decisions would have to be made about whether to burn the hydrogen directly in gas appliances, or whether to use it to generate electricity via fuel cells. “The problem with using hydrogen to generate electricity in fuel cells is that the purity of hydrogen has to be extremely high – you’re talking 99.95%. Any purity less than that can destroy a fuel cell, whereas if you’re running 98% hydrogen, then that would generally be suitable for gas appliances that are designed to operate on hydrogen,” he says.

“Some consider full electrification (i.e. electric appliances only) as a better option using hydrogen fuel cells or hydrogen turbines as the source of electrical power. However, in a centralised system this would require a major expansion of the current electrical infrastructure to cope with the additional energy demand. In a decentralised system (i.e. one where each house could have its own fuel cell), the current cost of fuel cells would make this option currently cost-prohibitive. Then there are some industry processes that require a great amount of heat, where burning hydrogen gas to generate the required heat would be more practical and economical than generating this heat through electrical power.”

Another problem, Enzo notes, relates to metering. “One issue that’s already been identified, apart from the compatibility of materials, is the actual billing itself,” Enzo says.

“There is still research being undertaken at the moment to determine what issues may arise by putting hydrogen through an existing billing meter.” Hydrogen has a lower heating or calorific value than natural gas, which means a greater volume of gas would have to flow to deliver the same energy as natural gas. This would have to be taken into consideration when measuring gas usage and billing customers.”

Despite the presence of such fundamental practical issues and variables – and we’ll touch on many more below – the Issues Papers present the widespread adoption of hydrogen in domestic settings as a ‘done deal’: in its proposed schedule of activities for 2020-22, Issue Paper 6 itemises actions including, “Flag to appliance manufacturers that the blending of hydrogen into gas distribution networks is on the horizon.” Such blunt advocacy goes beyond the introduction of a scientific discussion point, and drifts clearly into support for a specific, unsubstantiated course of action.

THE REAL AGENDA

A lack of consideration of rollout appropriateness, as well as the absence of any clear objective explanation about why hydrogen, specifically, is essential or even desirable in Australia, is understandable if we consider the real agenda of the Strategy guidelines: export profits derived principally from markets in Japan and South Korea.

Dr Finkel’s Proposal cuts to the chase: “A national strategy should focus on exports first.”5

This simple statement, arguably, undermines pretensions that hydrogen is essential to Australia’s domestic energy market. And in that context the Issues Papers suddenly look like a pathway to achieve export success via a private sector-controlled, government-lubricated public relations campaign, complete with highly questionable tactics designed to win the hearts and minds of the public along a route lined with regulatory and financial red carpets.

What are some of these red carpets? Issue Paper 1 highlights a suggestion (from a WA Chamber of Commerce submission) that a Strategy should not give preferential treatment to one production methodology over another 6, i.e. we must not dare to prioritise electrolysis over dirtier coal or gas-based methods. Of course, if electrolysis were embraced, then “From a commercial perspective, it appears likely in the short term that most hydrogen production will occur on-grid,” states Issue Paper 77. (As the Table above shows, this method produces more CO2 per unit of hydrogen produced than any other method.)

As for inconvenient regulatory hurdles and the policing of ‘clean’ production systems, i.e. “who makes and administers the rules for a guarantee of origin”, Issue Paper 4 has a helpful tip:

“One option would be an industry-developed and operated scheme. Industry ownership can reduce red tape and increase buy-in from participating companies.”8

Incredibly, the document proceeds to inform us that, “Regardless of who administers a guarantee of origin, it will be important to strike a balance between stringency and efficiency.”9

A counterclaim might be that strict regulations, strictly policed, are vital to ensure best practice and ethical behaviour.

Yet another tactic to facilitate corporate ownership of the industry, and to massage public acceptance, involves a blurring of the definition of ‘clean’. While most people might see ‘clean’ in black and white terms (either it is or it isn’t), Issue paper 4 notes no fewer than eight different ways of describing hydrogen, ranging from Green or Renewable to Blue, Brown, Grey, Yellow, etc.10

This list, presented immediately after the subsection ‘Testing consumer and customer preferences’, can only be interpreted as a toolkit for softening the definition of ‘clean’ according to consumer tolerances, rather than objective benchmarks.

A cynic might take the view that the above tactics serve to endorse the rushed introduction of a hydrogen industry, free from genuinely clean production processes.

The corporate biases of the Issues Papers – and their deficiencies as a framework for the objective analysis of hydrogen in the public domain – reach a low point in Issue paper 7, which addresses the potential for hydrogen-generated electricity to be integrated into wider energy systems. As the paper notes, “The role of governments is not to prescribe what future electricity systems should look like, but instead optimise market settings in the long-term interest of consumers.”11

On the contrary, one might respond that independent government oversight is fundamental to the organised and efficient creation of appropriate, fit-for-purpose energy infrastructure based on true public need rather than corporate opportunism.

Consider the following omissions from the Strategy proposal and Issues Papers:

At no stage do the papers establish a structure for assessing whether clean hydrogen assets should be owned and managed by public or private entities.

At no stage do any of the Issues Papers seek to establish the ideal scope of ‘clean’ hydrogen, specifically, in the wider context of alternative, more established renewable energy sources like solar and wind power.

At no stage do the Issues papers strategise an independent evaluation of actual market needs for hydrogen by sector (i.e. export, industrial or domestic use), by State, by region, or by localised geographical and demographic suitability.

By presenting heavily biased strategic directions, based on a litany of political and market assumptions, Dr Finkel is effectively acting as a public relations agent for a narrow band of private commercial operators. This may well be the most pragmatic way to kick-start a so-called clean hydrogen industry – but it does little to legitimise it within our broader public energy networks.

Let’s hope that the final Strategy contains more independent strategy when it is released later in the year.

‘CLEAN’ MEANS CLEAN

By Suzanne Harter, Australian Conservation Foundation climate change and clean energy campaigner.

Australia should only pursue a hydrogen industry if it is 100% powered by clean, renewable energy. Hydrogen should not be used as a way to extend the lifespan of fossil fuels.

Australia is well-placed to take advantage of the growing global demand for renewable hydrogen, driven by countries such as Japan and South Korea that are looking to cut their climate pollution, reduce health-damaging air pollution and meet international climate change commitments.

Renewable hydrogen offers an attractive zero emissions energy source that will not cause air pollution or wreck the climate. Falling technology costs mean renewable hydrogen is also fast approaching cost parity with the fuel sources it is seeking to replace.

Australia has some of the best solar and wind resources in the world. Hydrogen can be used to store solar and wind-generated electricity, allowing it to be transported anywhere in the country or overseas and used to power industrial processes or cars.

The trial in the Latrobe Valley, which uses brown coal to produce hydrogen, is inherently dirty and polluting. Even with unproven, resource-intensive carbon capture and storage.

We should instead focus our efforts on renewable hydrogen. If Australia established a ‘Guarantee of origin’ scheme – a tracking instrument to tag electricity from renewable sources and provide information to electricity customers about the source of their energy – it could offer Australia a market advantage in this emerging sector.

Footnotes:

1. Based on data in Issue Paper 4, page 9

2. See Issue Paper 1, page 5

3. See Issue Paper 6, page 3

4. See Proposal for a National Hydrogen Strategy, December 2018, page 7

5. See Proposal, page 5

6. See Issue Paper 1, page 4

7. See Issue Paper 7, page 5

8. Issue Paper 4, page 10

9. Issue Paper 4, page 10

10. Issue Paper 4, page 8

11. Issue Paper 7, page 8