Building valves industry posts considerable decrease in first half-year

In the first half of 2009, the turnovers of the individual product groups developed quite differently. The manufacturers of technical building valves were able to show a rather moderate drop of four per cent between January and June 2009. The turnover of manufacturers of heating valves retreated by a nominal eight per cent, whilst manufacturers of sanitary valves had to deal with a drop in turnover of 22 per cent.

In Germany, the turnover of manufacturers of building valves dropped by a nominal ten per cent in the first half of 2009. Reasons for this are on the one hand the consumers’ low propensity to buy durable goods in comparison to consumer goods. Due to this, necessary, but expensive, bathroom and heating renovations are postponed.

On the other hand the number of building permits for residential and non-residential buildings dropped considerably in the first five months of the year in comparison to last year. This drop in new construction activity has become noticeable throughout all of the stages of the supply chain and the industry, albeit somewhat delayed.

The development of foreign business was unable to help the sector to achieve an increase in turnover in the first half-year of 2009.

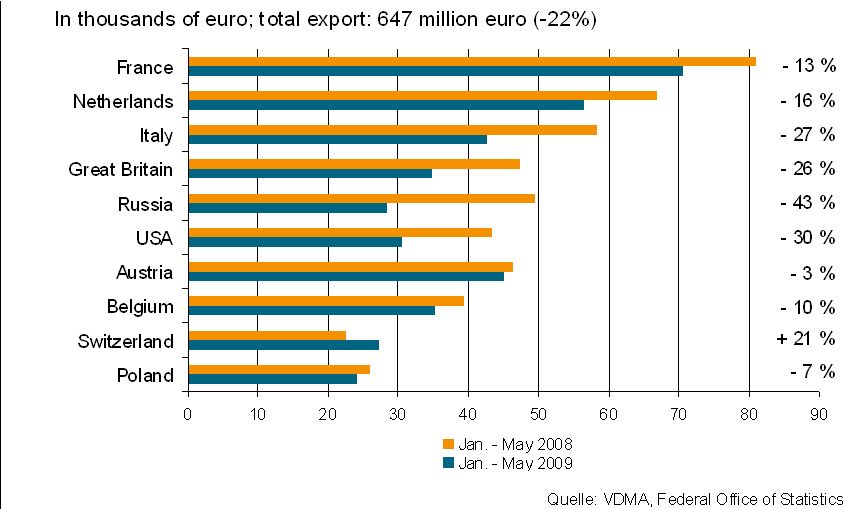

According to figures from the Federal Statistical Office the export of building valves decreased by approximately 22 per cent to 647 million euro. Above all, business with Russia (- 43 % to 28 million euro) and with the USA (-30 % to 31 million euro) has hit the companies badly.

Imports of building valves sank in the first half-year of 2009 by 23 per cent to 362 million euro. The most important supplier for Germany was China (+ 10 %to 66 million euro) in front of Italy (-23 % to 55 million euro) and Portugal (-53 % to 36 million euro). Taking this into account, the imported share from Eastern Asia remained relatively stable, whilst the share in Europe fell strongly.

Forecast 2009

The Valve Manufacturers’ Association further expects the decrease in turnover to continue in the building valves industry for 2009. Non-residential building construction which is dominated by commercial construction looks set to continue to fall sharply both throughout the remainder of this and the following year. It is expected that residential construction will continue to shrink in the coming year and will not start to recover until 2011.

Although the economic stimulus plan promises slight impulses in the 2nd half-year, the VDMA still does not expect any sustained market recovery in the next few months against the backdrop of the ongoing economic crisis.