Housing: HIA Calls for More Foreign Investment

Following the recent announcement made by the Treasurer, Jim Chalmers MP, on 10 December regarding Higher Foreign Investment Fees for Housing, the Housing Industry Association has called for more foreign investment – NOT greater taxes on foreign investment.

“In order to address the acute shortage of housing stock, governments need to attract more foreign investment, not increase taxes on them,” stated HIA’s Chief Economist, Tim Reardon.

“There are two very common misunderstandings about the shortages of housing in Australia. One is that there is a large volume of vacant homes, the second is that foreign investors are the cause of the housing shortage,” added Mr Reardon.

“Each census the Australian Bureau of Statistics reports that around 10 per cent of homes were vacant on census night.

“Around half of these ‘vacant homes’ are people away from their primary residence on census night as they are on holidays, some are for sale, some being renovated or are in regional areas away from employment opportunities.

“The ABS has reported that around 10 per cent of homes are vacant in each census since 1986, this figure is consistent with other developed economies and is not the cause of Australia’s housing shortage.

“It is a fallacy to think that 10 per cent of homes are unoccupied and unhelpful for policy makers to suggest that homes are being withheld from the market when a core problem is that governments continue to increase tax imposts on hew homes.

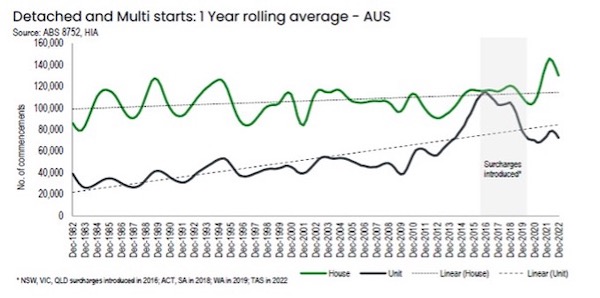

“Secondly, since 2015 a range of punitive taxes have been imposed on foreign investors by State and Federal Governments. The consequence of this is that these investors have withdrawn from the Australian market, and this is a key reason why the volume of apartments commencing construction is now almost half of what it was in 2016.

“If governments tax something, there will be less of that item.

“Foreign investors build new homes, they don’t live in them, then cannot take them out of the country and are central to addressing the shortage of housing in Australia. They are the key to addressing the inequity that falls hardest on Australian renters.

“One in ten Australian detached homes are built by a foreign owned company. These companies are finding it increasingly difficult to invest in Australia and build new detached homes, due to the punitive tax’s governments impose.

“In order to address the acute shortage of housing stock, governments need to attract more foreign investment by reducing the tax impost, they need to stop increasing the cost of building new homes by imposing additional regulatory and tax imposts and they need to assist local councils to invest in infrastructure.

“Changes announced in this year’s Federal Budget will assist domestic institutional investors to build new homes in Australia, but they have not yet filled the space left vacant by the exit of foreign investors from the Australian market,” concluded Mr Reardon.